Text or Call 770-940-9959 for Assistance with Quotes, with Group Discounts and Purchasing. We are Licensed Agents!

What is critical illness insurance and how does it work?

Critical illness insurance helps cover what health insurance doesn’t.

If you’re diagnosed with cancer, heart attack, stroke, or another covered condition, it pays up to $75,000 to use for out-of- pocket costs and anything else you need.

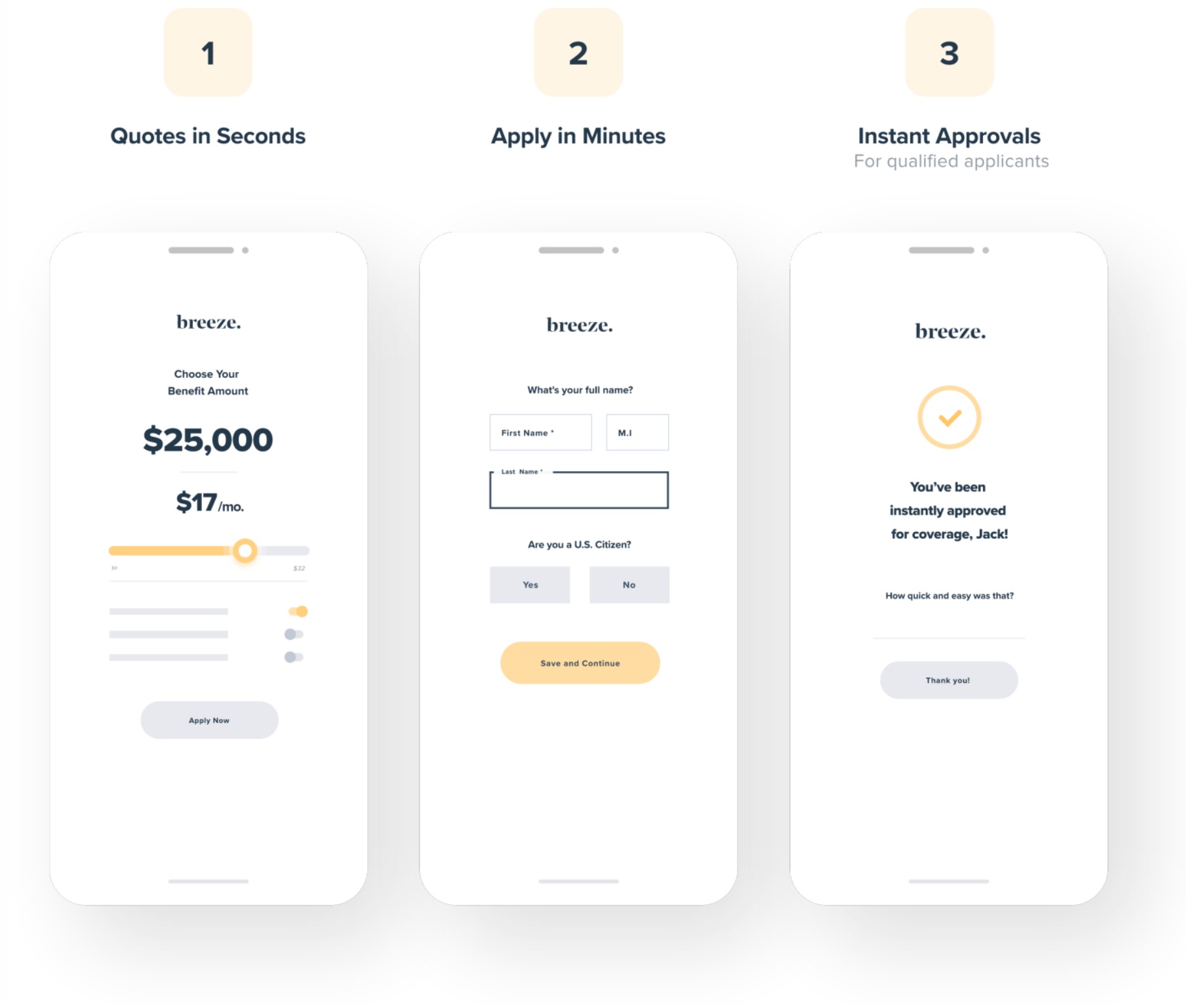

Breeze makes shopping for affordable coverage easy with a quick online process.

What is critical illness insurance and how does it work?

Critical illness insurance helps cover what health insurance doesn’t.

If you’re diagnosed with cancer, heart attack, stroke, or another covered condition, it pays up to $75,000 to use for out-of- pocket costs and anything else you need.

You Must Enter an Agent Email tony@patriot.joinapro.com to get a Quote

Instant quotes. Online application. Flexible benefits.

Critical Illness Insurance

- Issue ages 18-70

- Up to $75k lump sum benefit with simplified underwriting

- Covers cancer, heart attack1, stroke, Alzheimer’s, paralysis, coma, kidney failure, coronary bypass surgery, major organ transplant, and angioplasty

- Policies issued by Assurity Life

1. Heart attack does not include established (old) myocardial infarction occurring prior to the issue date, sudden cardiac arrest, cardiac arrest or cardiopulmonary arrest.

You Must Enter an Agent Email tony@patriot.joinapro.com to get a Quote

You Must Enter an Agent Email tony@patriot.joinapro.com to get a Quote

Why offer critical illness insurance to your staff?

47%

of Americans don't have enough savings to cover an unexpected $1,000 expense.

66%

of all personal bankruptcies in the U.S. are tied to medical issues.

70%

of working Americans couldn't make it a month without a paycheck before experiencing financial hardship.

Why offer critical illness insurance to your staff?

47%

of Americans don't have enough savings to cover an unexpected $1,000 expense.

66%

of all personal bankruptcies in the U.S. are tied to medical issues.

70%

of working Americans couldn't make it a month without a paycheck before experiencing financial hardship.

Offer critical illness insurance to your staff

By giving your staff an easy way to apply for critical illness insurance, you’re helping them prepare for the unexpected and improve their financial security — while you grow your business.

You Must Enter an Agent Email tony@patriot.joinapro.com to get a Quote

You Must Enter an Agent Email tony@patriot.joinapro.com to get a Quote

Our customers love us. We think you will, too.

NOT APPROVED FOR CONSUMER USE. NOT AVAILABLE IN NEW YORK. CRITICAL ILLNESS INSURANCE PROVIDES LIMITED BENEFIT COVERAGE. It is not a comprehensive major medical plan or Medicare supplement policy and does not satisfy the requirement for minimum essential coverage under the Affordable Care Act (ACA). The description of benefits is intended only to highlight the insured’s benefits and should not be relied upon to fully determine coverage. If this description conflicts in any way with the terms of the policy, the terms of the policy prevail. This policy may contain reductions of benefits, limitations and exclusions. Availability of this product, final underwriting requirements, benefits and cost will depend on your application. Policy Form No. I H1820 underwritten by Assurity Life Insurance Company, Lincoln, NE. Assurity is a marketing name for the mutual holding company Assurity Group, Inc. and its subsidiaries. Those subsidiaries include but are not limited to: Assurity Life Insurance Company and Assurity Life Insurance Company of New York. Insurance products and services are offered by Assurity Life Insurance Company in all states except New York. In New York, insurance products and services are offered by Assurity Life Insurance Company of New York, Albany, NY. Product availability, features and rates may vary by state.

NOT APPROVED FOR CONSUMER USE. NOT AVAILABLE IN NEW YORK. CRITICAL ILLNESS INSURANCE PROVIDES LIMITED BENEFIT COVERAGE. It is not a comprehensive major medical plan or Medicare supplement policy and does not satisfy the requirement for minimum essential coverage under the Affordable Care Act (ACA). The description of benefits is intended only to highlight the insured’s benefits and should not be relied upon to fully determine coverage. If this description conflicts in any way with the terms of the policy, the terms of the policy prevail. This policy may contain reductions of benefits, limitations and exclusions. Availability of this product, final underwriting requirements, benefits and cost will depend on your application. Policy Form No. I H1820 underwritten by Assurity Life Insurance Company, Lincoln, NE. Assurity is a marketing name for the mutual holding company Assurity Group, Inc. and its subsidiaries. Those subsidiaries include but are not limited to: Assurity Life Insurance Company and Assurity Life Insurance Company of New York. Insurance products and services are offered by Assurity Life Insurance Company in all states except New York. In New York, insurance products and services are offered by Assurity Life Insurance Company of New York, Albany, NY. Product availability, features and rates may vary by state.

Assurity Critical Illness Insurance

Issue ages

18 through 70 years (age nearest birthday)

Underwriting classes

Male/Female, Tobacco/Non-Tobacco

Benefit amounts

- Simplified Underwriting: $5,000 - $75,000

- Fully Underwritten: $75,001 - $500,000

Benefit amount reduced by 50% in the later of the third policy year and the policy year following the insured’s 70th birthday.

Additional diagnosis benefit

The insured may receive benefits for each different illness covered if the date of diagnosis or procedure is separate from the prior illness by at least 6 consecutive months, and the new illness is not caused by or contributed to by a critical illness for which benefits have already been paid.

Covered conditions

- Heart Attack* — 100%

- Coronary Artery Bypass Surgery — 25%

- Angioplasty — 25%

- Stroke — 100%

- Invasive Cancer — 100%; Invasive and Non-Invasive Cancer combined cannot exceed 100%

- Non-Invasive Cancer — 25%; Invasive and Non-Invasive Cancer combined cannot exceed 100%

- Kidney (Renal) Failure — 100%

- Major Organ Transplant (liver, kidney, lung, entire heart or pancreas) — 25% payable when insured person is placed on registry with the United Network for Organ Sharing and 75% payable upon completion of the organ transplant surgery

- Advanced Alzheimer’s Disease — 100%

- Paralysis — 100%

- Coma — 100%

*Heart attack does not include established (old) myocardial infarction occurring prior to the issue date, sudden cardiac arrest, cardiac arrest, or cardiopulmonary arrest.